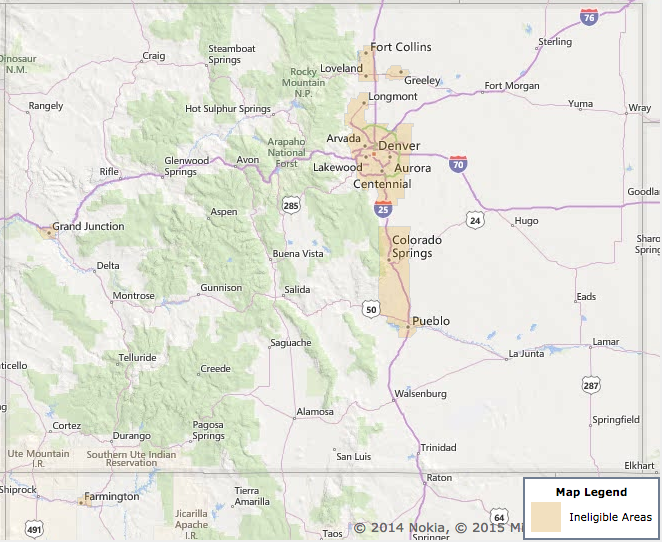

Usda Loans Colorado Map

All mortgage loans regardless of program require mortgage insurance if the down payment is less than 20.

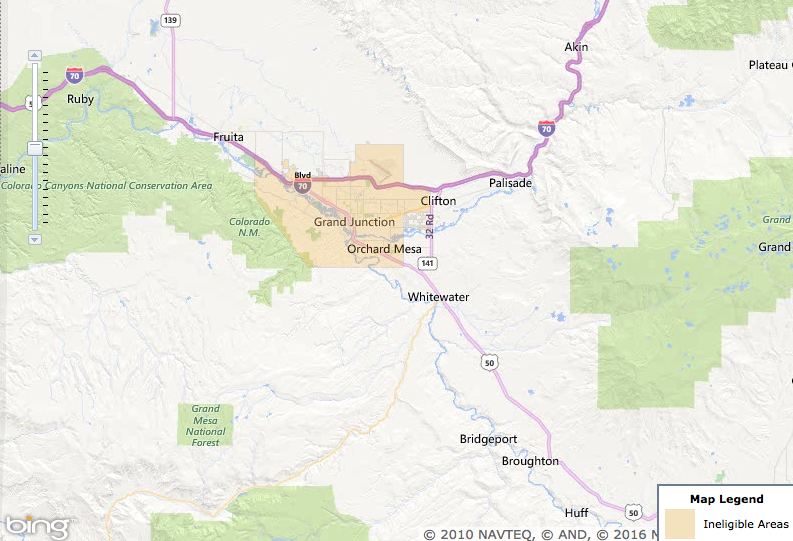

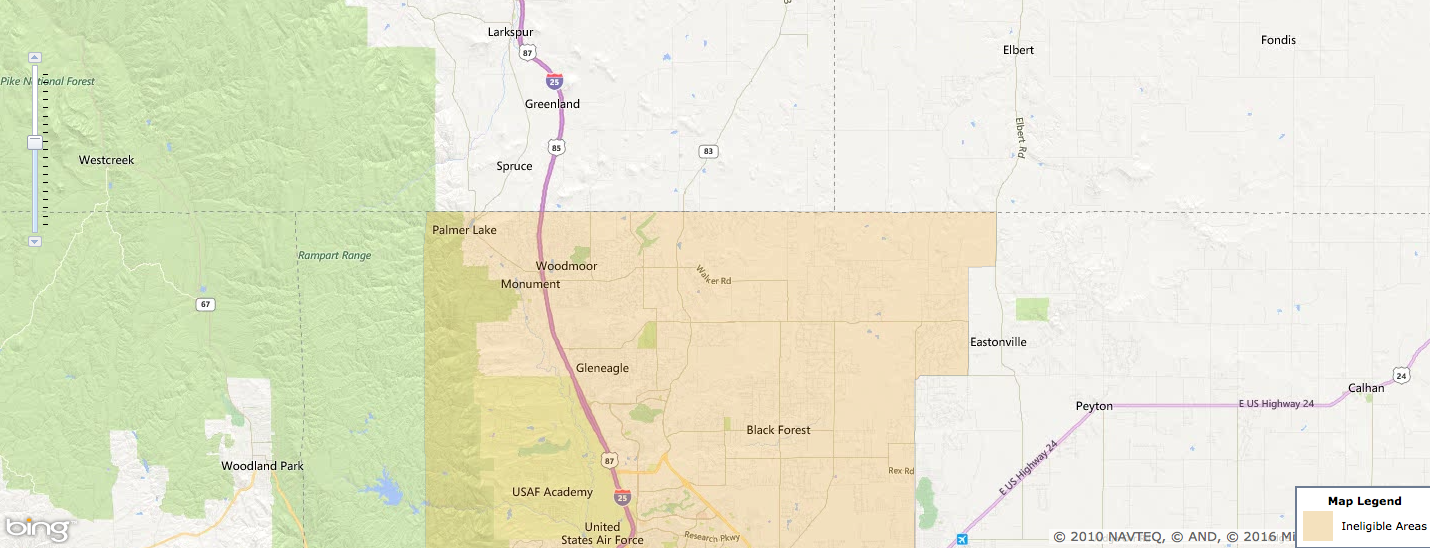

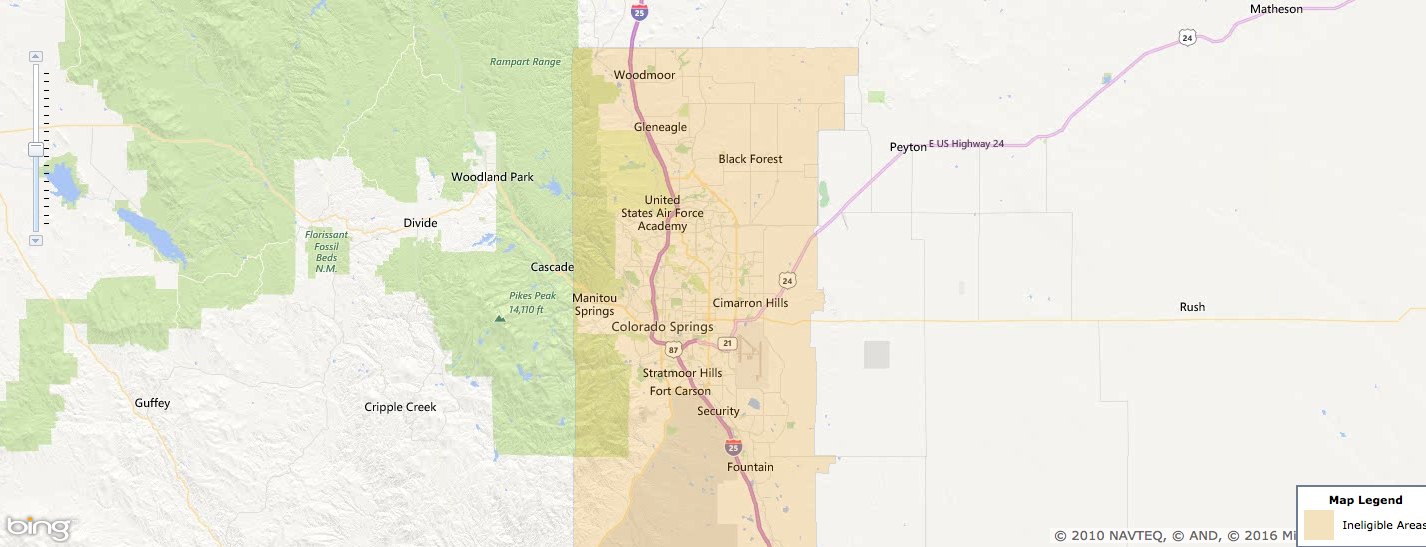

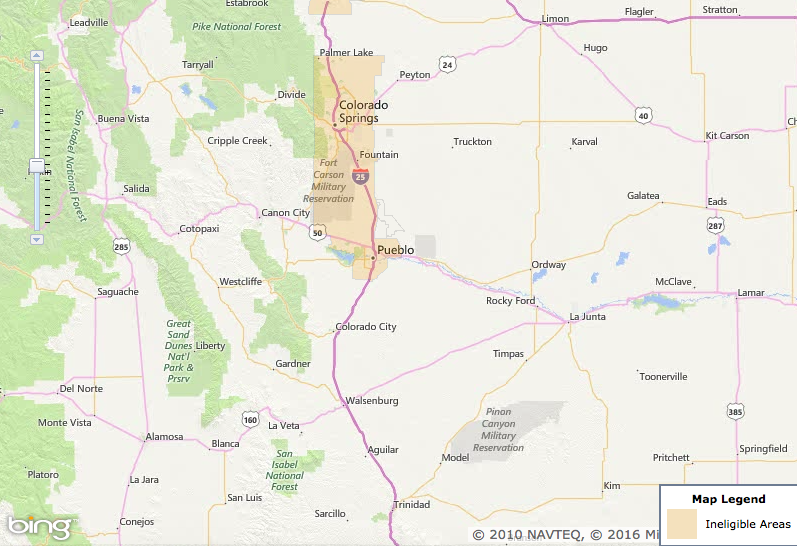

Usda loans colorado map. Single family housing direct home loans in colorado. In addition to income limits other eligibility requirements for the usda backed mortgage guarantee loan program. Click here to consult the usda s map and table indicating income limits by location. Since the usda loan is a zero down mortgage all loans are subject to mortgage insurance fees.

To be eligible for a usda backed loan in colorado an applicant must meet certain income limits. Single family housing repair loans grants in colorado. Community facilities direct loan grant program in colorado. For example a 200 000 home will require a.

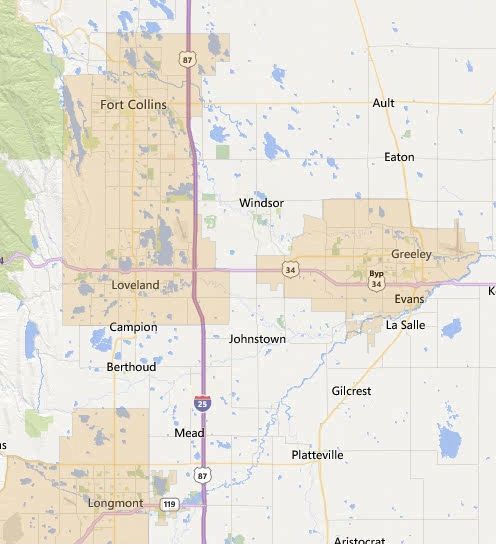

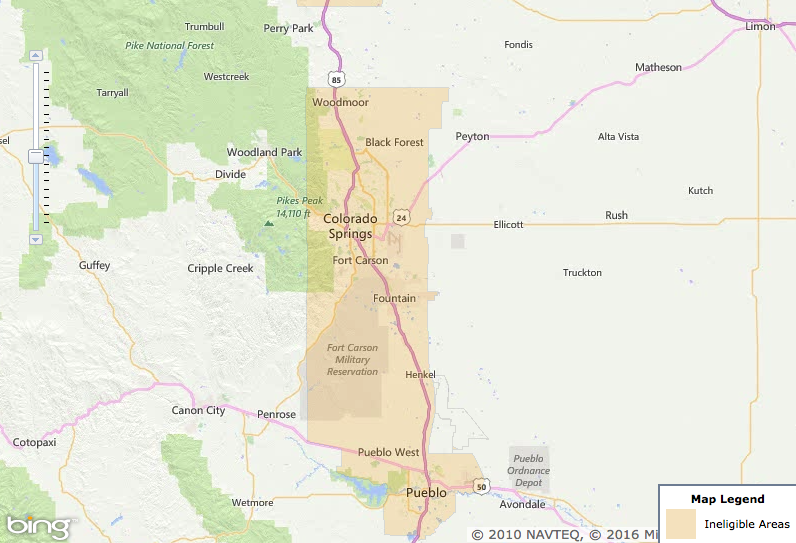

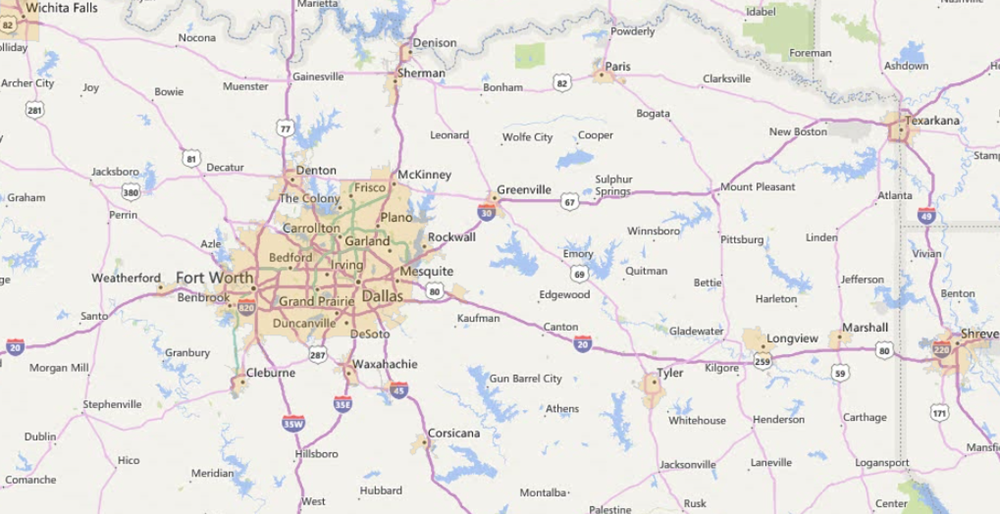

The easiest way to find usda loan areas on your own is with the usda maps. Rural energy for america program energy audit renewable energy development assistance grants in colorado. Usda uses buyer paid mortgage insurance premiums to continually fund the program. If you have.

Once you accept the site brings up a map of the united states. Click to see the latest mortgage rates searching a specific address. The united states department of agriculture created the rural development loan also known as the usda guaranteed loan or usda rural housing loan to help promote home ownership for lower and middle income households. Providing these affordable homeownership opportunities promotes prosperity which in turn creates thriving communities and improves the quality of life in rural areas.

These limits vary by location and household size. First you must accept the disclaimer. First choose single family housing guaranteed this is the most common usda program. Next decide if you want to search a specific address or a general area.

Usda rural development s section 502 direct loan program provides a path to homeownership for low and very low income families living in rural areas and families who truly have no other way to make affordable homeownership a reality. New usda broadband program. Advantages of the usda rural development program below are some of the benefits that usda loans. While these mortgages are known for assisting low income families to buy a home in a rural area usda loans are actually available to moderate income households as well.

As of october 2016 the upfront fee paid at closing is 1 00 and the annual fee is 0 35. Usda mortgage insurance is separated into an upfront fee and an annual fee.